Debt Consolidation: Everything you need to know

The year 2020 has been harsh on almost everyone. If you are not in the top 1%, chances are that it was harsh on you as well. Estimates say that 49% or more people in the U.S. expect to live paycheck to paycheck this year. Moreover, an average american household carries around $8,400 in credit card debt.

These are alarming figures and if you’re struggling with your debts, then we have something for you. There are a lot of strategies you can use to pay off your debt. One such strategy is debt consolidation. But, we’d like you to make an informed decision. For that reason, we’re going to help you with all you need to know about Debt Consolidation in this article.

You’ll learn about debt consolidation, how you can use debt consolidation effectively, things to take care of, pros and cons of debt consolidation, and whether debt consolidation is right for you.

Let’s begin with understanding debt consolidation.

What is Debt Consolidation?

Debt Consolidation is used to combine and replace your existing debt to reduce its burden using an unsecured personal loan. So, if you take out a debt consolidation loan, you use the money borrowed to pay off your other debts. You can use it to pay off debts like credit card balances, medical bills, and more.

With a debt consolidation loan, you’ll have one monthly payment amount and one monthly due date only. This helps you avoid the hassle of having to pay several different lenders.

Debt consolidation loans are mostly used to pay off and combine credit cards, personal loans, or other debt.

Debt consolidation loans help you simplify your monthly payments. Not just that, they also help you avoid high credit card interest rates and save money. Streamlining and consolidating your debts can help you steer clear of the monthly payments you can’t afford. All such difficult monthly payments will be replaced by one single manageable payment.

You’ll only have one new loan with a new interest rate, new monthly payment, and new payoff date. Take care to choose a debt consolidation loan with the right terms that take you closer to your debt goals.

Who is Debt Consolidation for?

Debt consolidation is not for everyone. If you have a reasonable amount of debt and have a plan in place to avoid future debt, then it might be right for you.

In such a situation, debt consolidation might help you lower your monthly interest rate. Or it can even adjust the terms of the loan to a lower monthly payment. So, if used correctly, debt consolidation can allow you to save money while paying off your balances faster than before.

Advantages of Debt Consolidation

Fixed Payment with Lower Interest Rate

The interest rate on your debt consolidation loan might be lower than the rate you’re paying on your existing balances. Over time, this can save you a significant amount of money.

Moreover, if you choose a loan with a fixed interest rate, then your monthly payment will remain the same as throughout the repayment period. This can help make budgeting easier for you.

Fixed End Date

With a loan, there’s always a set amount of time during which you’ll be paying back your debt. The same is not true with a credit card. With a credit card, you don’t have a set date when you’ll be finished paying off your debt. You can continue to use your card while paying off the debt. This can increase your total balance and the amount of interest you’ll pay.

No Collateral

In debt consolidation, you have the option to go for an unsecured debt consolidation loan. Such a loan will not use your home or vehicle as collateral. So, your personal property and assets will be safe and secure.

Disadvantages of Debt Consolidation

Interest Rates, Fees, and Costs

Make sure that the interest rate on a debt consolidation loan is lower than the rate on your existing debt. Lenders may charge origination fees, application fees, prepayment fees, late fees and other fees. Before you sign anything, ask the lender to tell you if there are any fees associated with the loan. Also, enquire about the total amount you’ll pay in fees.

Higher Payments

In a debt consolidation loan, you set a fixed amount of time to pay off your loan. This can increase your monthly payment more than the amount you were paying on your debts before consolidation. Before you decide to consolidate your debt, ensure that the payment on your loan won’t strain your budget.

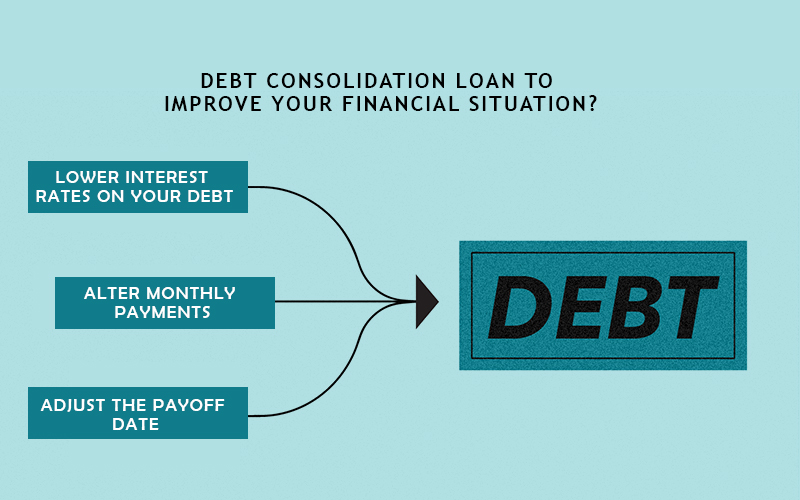

How can you use a Debt Consolidation loan to improve your financial situation?

Let’s take a look at a few ways in which a debt consolidation loan can help improve your financial situation.

Lower interest rates on your debt

Debt consolidation is so enticing because it gives you a chance to pay less interest. However, you’ll need a good credit to consolidate debt to a lower interest rate.

If you have a good credit rating, getting a lower interest rate on a debt consolidation loan might be simple. But, don’t get disheartened if you have average or fair credit. A borrower with average credit might also be able to save by consolidating high-interest debt to a lower amount.

Alter Monthly Payments

Debt consolidation also gives you a chance to modify or change your monthly payments. It makes your life simpler by replacing multiple monthly payments with a single, easy-to-track payment.

You can also lower your monthly payments by getting a lower interest rate or choosing a longer repayment plan. If debt repayment is straining your budget, consolidating it can make enough room for you to breathe and sustain.

Adjust the Payoff Date

With debt consolidation, you are also given the opportunity to adjust and alter your payoff date.

Your loan term and payoff date affect the total interest you pay over the life of the loan. A shorter term implies higher monthly payments but it’ll help you avoid years of interest charges.

Do your math to see if it’s worth extending the payoff date on your debt consolidation loan. Having this option makes debt consolidation all the more beneficial and flexible.

Things to take care of in Debt Consolidation

Before you decide to go for debt consolidation, make sure that you check the following details:

Take Origination and other fees into account

A lot of debt consolidation loans also carry origination fees in addition to interest charges. These fees can range anywhere from 1% to 6% of the total loan amount. Such fess can add to your total loan costs.

Generally, origination fees are taken out of the loan funds before the lender disburses them to you.

Not all lenders charge this fee, so you might want to apply with those that don’t charge it. You should also compare APRs on debt consolidation loan offers. APRs will reflect the total loan costs, including the interest rate and origination fee.

Don’t borrow after Consolidating your Debt

You must have a post-debt consolidation plan in place if you opt for debt consolidation. Consolidation of debts must be followed by a responsible plan of action to avoid taking on additional debt.

Once you have consolidated your debt, you might free up available lines of credit. Make sure that you have a strategy in place to avoid charging new purchases to your credit cards. If not, you might max them out and end up in twice as much debt.

Is Debt Consolidation right for you?

You must do your research and due diligence before deciding to go for debt consolidation. It’s probable that after doing your research you realize that it’s not right for you.

Maybe you are already paying low interest rates so debt consolidation won’t help you much. Or, maybe you have a bad credit history which is making it difficult for you to opt for debt consolidation.

If it’s not for you, it’s not for you but that does not mean that you have no options left. You can make a strategic plan to pay off your debts, change your financial habits a bit, and pay extra on your debts whenever possible.

Let’s assume that you’re struggling with your current payments. Or maybe you are at risk of defaulting and still have several years left on your loans. In such a case, debt consolidation might be a great option for you.

But if you’re managing to make the payments and only have a couple of years left until your payoff date, you might want to consider other options instead.

At the end, you have to make a choice. Whether it is worth going for debt consolidation for your specific situation or not. Give this decision a deep thought and think about it from all perspectives before reaching a decision.

How GConnectPro can help you

You should consider debt relief if the burden of debt is too great for you to manage on your own. Debt relief can help you get your finances under control if you’re struggling to keep up with multiple types of debt.

GConnectPro can provide the required support to people overburdened by debt. On your behalf, we’ll negotiate with creditors to reduce monthly payments, rates and the amount you owe. We can also help you restructure your debts into a single monthly payment plan. Moreover, you can approach GConnectPro if you need counseling to help you create a budget that works. We’re here to help you, even in the most difficult of times.

Got any questions? Let us know in the comments below or apply here for free online consultation.

Write a reply or comment

You must be logged in to post a comment.