SBA Loans: The Ultimate Guide to securely raising funds for your Small Business

An SBA loan is the right choice if you want to start or expand your small business, purchase commercial real estate, equipment, supplies, machinery, and even long-term & short-term working capital. It is specifically guaranteed and backed by the U.S. Small Business Administration for supporting and encouraging the development of small businesses.

So, if you’re thinking about starting or growing your own business, you should consider getting an SBA loan. A Federal agency guarantees these loans which enables lenders to offer them flexible terms and low interest rates. This makes them conducive to the needs of small businesses.

Do you want to save your failing business? Or would you like to expand your business? Then we think you should consider getting an SBA loan for your business.

We have created this comprehensive guide to SBA loans as an answer to all your questions about SBA loans.

TABLE OF CONTENTS

- What is the U.S. Small Business Administration (SBA)?

- What is an SBA Loan?

- Types of SBA Loans

- Understanding the Term of the SBA Loan

- A few Misconceptions about SBA Loans

- Requirements for an SBA Loan

- Documents Required to apply for an SBA Loan

- Advantages of SBA Loans

- Drawbacks of SBA Loans

- Are SBA Loans right for your business?

What is the U.S. Small Business Administration (SBA)?

The U.S. Small Business Administration or the SBA is a federal agency created in 1953 to aid, counsel, assist, and protect the interests of small business concerns.

As an independent agency of the government, the SBA partners with both private and public organizations to deliver its services and offerings, including loans. So, in essence, an SBA loan is not a direct loan from SBA itself. Rather, it is a loan offered by a commercial lending partner but guaranteed by the SBA. The private and public commercial lending organizations structure the loan according to official SBA requirements. This helps to minimize risk for both partners (lenders) and borrowers.

Since loan guarantee requirements and practices depend on the US government, changes to policies or economic conditions may change terms of lending.

The SBA has diversified, since its inception, to offer lending guarantees, nationwide counseling and resources, disaster relief, and many other programs.

You can apply for an SBA Loan if you are part of a US territory which includes the United States, Puerto Rico, Guam, and the U.S. Virgin Islands. If you are not a part of any of these territories, then there are several other funding options available.

What is an SBA Loan?

Many small businesses depend on a small business loan to fuel growth and other initiatives.

SBA loans are small-business loans guaranteed by the SBA and issued by participating lenders, like banks & financial institutions.

An SBA loan is a traditional debt-based financing tool with special advantages for small business owners. These loans provide up to $20 million in small business funding. Small Businesses can use the funding for starting a new business, purchasing an existing business, expanding operations, buying equipment, or used as working capital.

Even though individual banks provide and fund these loans, the SBA guarantees 50 to 90 percent of the loan if it goes into default. This is why lenders are willing to offer favorable terms and relaxed conditions to small business owners.

Since SBA loans are only available for ‘Small Businesses’, you need to conclusively determine whether your business is legally considered a ‘small business’ or not. For this, you can check the US Small Business Administration’s Size standards guide. The SBA’s size standards help determine whether your business qualifies as ‘small’.

Now that you know what an SBA loan is, let us take a look at the different types of SBA loans for different circumstances.

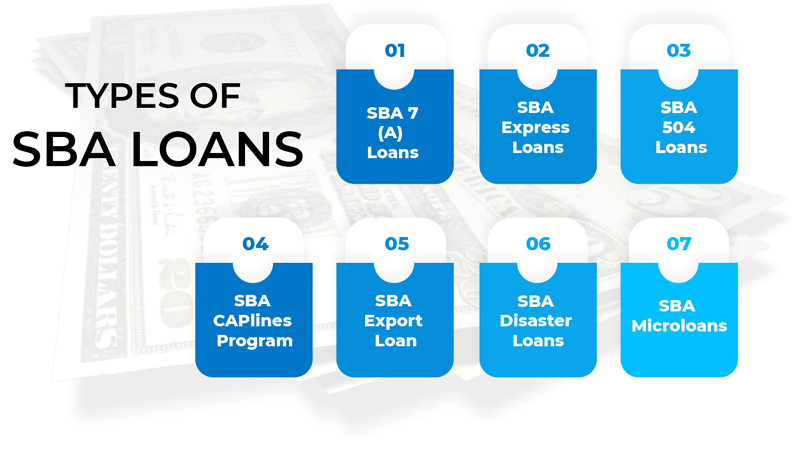

Types of SBA Loans

SBA offers different types of loans to provide opportunities to business owners in specific markets, difficult situations, and in need of small funding amounts. Let us take a look at 7 types of SBA loans offered under the SBA lending program:

1. SBA 7(A) Loans

SBA 7(a) loans offer up to $5 million in funding. You can utilize this for just about any business purpose. SBA 7(a) loans are one of the most affordable options offered because they typically have low interest rates of 7% to 9.75% and longer repayment terms of up to 10 years. The repayment terms can go up to 25 years in the case of commercial real estate.

2. SBA Express Loans

The SBA offers an Express Loan program for those in urgent need of funding. The Express Loan offers a maximum funding amount of $350,000, stricter eligibility requirements, and slightly higher interest rates. The interest rates are higher because the SBA only guarantees 50 percent of these loans. But, with these loans, you can get the initial approval in a matter of days and total funding in only a few (3-4) weeks.

3. SBA 504 Loans

The SBA partnered with the Certified Development Companies (CDC) to offer 504 Loans to support and promote economic development. You must use these loans to fund fixed assets such as purchasing existing buildings or building new facilities, which are at least 51 percent owner-occupied. SBA 504 loans offer repayment terms of up to 10 and 20 years.

4. SBA CAPlines Program

A line of credit through the SBA CAPLines program may be a good fit for those seeking short-term working capital. CAPLines covers four different credit programs, which are all offered in conjunction with a 7(a) or 504 loan. These programs have very low interest rates (5.75% to 8.25%), but short repayment terms of up to five years.

5. SBA Export Loan

Business owners involved in international transactions might qualify for an SBA Export loan. The interest rates and repayment terms can vary greatly for Export loans. These loans are only available to businesses that have been in operation for over a year and are engaged in exporting products overseas.

6. SBA Disaster Loans

If you find yourself to be a victim of a natural disaster, the SBA offers support in the form of Disaster loans. Businesses that can furnish proof of negative impact resulting from a disaster can receive up to $2 million in financing with rates as low as 4 percent.

7. SBA Microloans

The SBA now offers a Microloan program for home-based, online, and freelance business owners who often require less funding to launch or grow their businesses. You can use Microloans for most business purposes, except for paying existing debts and buying real estate. Unlike other SBA programs, the SBA itself funds Microloans but they originate from and receive approval through non-profit intermediary lenders.

Understanding the Term of the SBA Loan

Whenever you’re making a significant financial decision that will impact your business, it is important to clearly understand what you’re agreeing to. You need to know the basics before trying to understand the terms of an SBA loan. Let us try to understand some common terminology used in SBA loans terms:

Interest Rate

With all debt-based financing, the amount you repay to the lender will depend on your interest rate and term of the loan. The interest rate is a percentage of your principal (loan amount) and is applied to the total unpaid amount. SBA interest rates are set based on the daily prime rate plus the lender’s spread. The Daily Prime rate is set by the Federal Reserve. Your interest rate can either be fixed, meaning it will stay the same during the life of the loan or variable, meaning it can change over time.

Down Payment

The down payment is the amount of cash you will contribute to the project. It is also called an equity injection. Making a substantial down payment is a requirement of all SBA loan programs. Your inability to make a large enough down payment can disqualify you from being approved. The requirements range from approximately 10% to 30% the principal.

Closing Costs

Depending on the type of SBA loan you qualify for, the closing costs and fees will vary. Additional costs to consider may include guarantee fees, packaging fees, loan broker fees, appraisal fees, and business valuation fees. You must take all of these costs into consideration when calculating how much cash you’ll need available in addition to your down payment in case your lender wants to come to the table with them.

Repayment Schedule

Your loan terms also include a repayment schedule or an amortization schedule. In this, you’ll find details of your repayment schedule and whether you may be able to save money on interest payments if you can pay the loan back in less time.

A few Misconceptions about SBA Loans

There are a few common misconceptions about the SBA and SBA loans. We figured we’d clear them out once and for all so that there is no confusion in your mind.

- SBA does not lend: The SBA itself does not lend directly and almost all SBA lending is done through individual banks and financial institutions. SBA guarantees a major portion of the loan, which minimizes the risk and encourages banks to work with small business owners.

- SBA loans require collateral: Borrowers assume that since SBA guarantees the loans, they don’t have the same collateral requirements as other loans. But that’s not the case. Almost all lenders require the business owners to sign a personal guarantee to secure the loan.

- Good Credit Score is not everything: A good Credit Score is important in securing the loan but it is not the only factor. There are several other important factors as well.

- Loan Approval is not solely based on Business: You should not be too confident if your business has a history of strong revenue. Lenders look at many other factors, including your personal credit score and history, before approving the loan.

Requirements for an SBA Loan

There are a lot of requirements that you need to satisfy before getting approval for an SBA loan. Let us take a look at a few such basic requirements that you must fulfill.

- Down Payment: While every SBA loan requires a down payment, the amount can vary greatly by which type of business you’re funding

- Personal Guarantee: A Personal guarantee is a promise that if the business cannot repay the loan, you will then be personally responsible for payments.

- Owner Guarantee: An SBA loan requires a personal guarantee from all owners with 20 percent or more ownership.

- Business Plan: An important aspect of any SBA loan is the written business plan. Your business plan, which covers 10 essential elements of your business, gives lenders an insight into your business structure as well as revenue projections and market position.

- Debt Service Coverage Ratio: For all loans over $350,000, the SBA requires a Debt Service Credit Ratio of 1.15 or greater, as described in their credit standards.

- SBA Lending Limits:

Let us take a look at the lending limits for different SBA lending programs:

(i) SBA 7(a) Loan: $5 million

(ii) SBA 504 Loan: $20 million

(iii) SBA Microloan: $50,000

(iv) SBA Disaster Loan: $2 million

(v) SBA Express Loan: $350,000 - Two years- Time in business: Your business must be at least 2 years old for it to qualify for SBA loans.

- Annual Revenue: Your business must have made sales of at least $120,000 in the past 12 months.

- Personal Credit Score: Your Personal Credit Score must be 600 or above.

- US Residence: Your business must reside in the territory of the US which includes the United States, Puerto Rico, Guam, and the U.S. Virgin Islands.

Documents Required to apply for an SBA Loan

You must collect and compile the following documents to make the loan approval process easier:

- 2 years of Personal Tax Returns

- 2 years of Business Tax Returns

- YTD Balance Sheet

- YTD Profit & Loss Statement

- Debt Schedule

Advantages of SBA Loans

The SBA and its lending programs were specifically built to benefit small business owners. In this section, let us take a look at how SBA loans can be advantageous for small businesses

- Buying Capacity:SBA loans range from $30,000 to $25 million in funding. Such a wide range provides you the buying power and flexibility you need as a business owner, to launch your dream project.

- No Ballooning Costs:You’ll have set, predictable monthly payments while repaying an SBA loan. The ability to accurately estimate your costs is of great importance when running a small business.

- Low Interest Rates:Since SBA guarantees the loans, the banks are more willing to provide low interest rates. These rates are set lower to support small businesses.

- Combine Financing:The ability to combine SBA with other funding options for the down payment makes it one of the most flexible financing options available for small business owners.

Drawbacks of SBA Loans

There are some drawbacks or challenges in obtaining SBA loans. These challenges may or may not make a difference when deciding if an SBA loan is the right funding option for you. But, you should be fully aware of any potential obstacles.

- Required Collateral: Even though the SBA guarantees most of the loan for the lender, collateral is still, almost always, required to secure the loan. As a borrower, you will have to put up your most valuable assets as collateral for the loan.

- Inconsistencies with Bank: One of the most challenging aspects of SBA lending is finding the right bank to approve your loan. It’s common to get rejected for lending by one bank, but approved by another. We, at Global Connect Pro, have simplified this process for you. You can contact us to enquire in detail or you can apply online for an SBA loan on our portal.

Are SBA Loans right for your business?

The answer to the above question will firstly depend on whether your business qualifies as a ‘small’ business. If yes, then secondly you will need to explore in detail all the different types of SBA loans. This will help you determine which type of SBA loan is right for your business in the present situation. Then you’ll have to check out the offers by various lenders offering SBA loans and compare their offerings. Compare all the costs, charges, interest rates, repayment terms, and all such factors that will affect your decision.

Once you have analyzed all the options, you will be in a better position to pick out the option that is right for your business. Before finalizing, thoroughly examine the loan terms and documents. Go through every major and minor detail. Once you find that all the terms and conditions are satisfactory, you’ll know for sure if that particular SBA loan is right for you or not.

Did you find this article informative? Did we miss something important? Let us know in the comments below!

Do you want to apply for an SBA loan with Global Connect Pro Financial?Apply now on our portal!

Want to know more about the best business finance tools to get funding for your business? Get in touch with us today and we will help you out!

Write a reply or comment

You must be logged in to post a comment.