What is Credit Repair – Everything You Need To Know

Are you struggling with a poor credit score? Don’t know how to repair your credit? If this is your concern then it is time for you to switch credit repair companies. But do you know what credit repair services really are and how it works? If Not then we are here to help you understand everything you need to know to get all your credit query resolved.

In this post, we are going to explain A to Z of Credit Repair. So, forget settling for lower credit, keep reading this post and find out what credit repair is, how it works and what credit repair companies do to fetch out every negative element from your credit report.

TABLE OF CONTENTS

What is Credit Repair?

When you struggle with a bad credit score you look for a solution to make your credit score work. You either do it yourself or search for a credit repair expert who can better your credit score with their skill. So, what exactly is their offered credit repair service?

The term “Credit Repair” refers to the number of actions performed to find every negative item affecting your credit score in your credit report. This service tends to perform to remove or correct every harmful and unverifiable item placed in your credit report. In return, you need to pay some amount as a service fee to the company. This is a great solution to any of your credit report issues.

Yet we say there’s always a way to clean up your credit issues at no cost on your own. All you need is to schedule, research, and take some time to read and understand the norms and you will be all set to find out every disputed item within a few days of work.

How do Credit Repair companies help?

A credit repair company acts as a third party and works to find out unverified information and correct or remove it by sorting out all items on your report in exchange for service payment. Many people confuse credit repair companies with credit counseling agencies. The credit counseling agencies offer free credit and debt reports along with their financial reviews with the view to let people understand how they can manage their financial situations.

However, you need to be aware while choosing such service-providing companies. Many credit companies guarantee their clients offer credit service that is designed to remove harmful items from their clients’ reports. But in reality, they cleverly remove their client’s correct data. To make their report fall under the repair category before it falls naturally.

Since this industry is full of scammers, we understand how difficult it is to trust any organization that guarantees you help not scam. Thus, to avoid getting fooled by such scammers, you must research your preferred organization before the agreement and hand over your credit details to them.

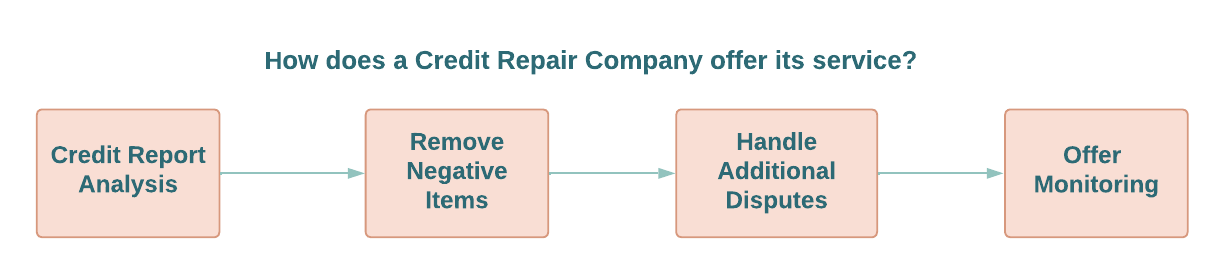

How does a Credit Repair company offer its service?

As you know that a credit repair service is performed by excluding negative items from your credit and ensuring making your report as accurate as possible. Here is the list of actions a credit repair company performs (Credit Repair Process) to aid you right credit service:-

1. Credit Report Analysis

They initially perform credit report analysis, this includes cross-checking or reviewing your credit reports sourcing it from three main sources “Credit Reporting Bureaus” these are:

- Equifax Credit Report

- Experian Credit Report

- TransUnion Credit Report

They go through the credit report and find any negative items if available they suggest appropriate feedback on how you can fix those items.

2. Remove Negative Items

The next step involves the removal of negative items, this is performed via informing credit reporting Bureaus by your hired repair expert. They send hidden unsupported negative items to bureaus to get sorted out from your credit report.

3. Handle Additional Disputes

In some cases, some credit items need more care compared to others quick fix negative items. These experts handle such delicate disputes too.

4. Offer Monitoring

The final step involves constant support and guidance offered by your credit repair company, this is a core quality element of a good company. Remember it can take 1 month or a whole 7+ years to get your credit repaired, it completely depends on you how you want to get your credit treated. And if harm is done then one must keep faith in their expert as credit repair does not happen overnight, it took time.

Is Credit Repair Legit?

Yes, offering credit repair service under which correction or removal of incorrect information from a credit report is legitimate. According to Federal Trade Commission under the Consumer Protection and Credit Repair Organizations Act, only the organization that offers a false promise or misleads to boost a client’s credit score by disputing the correct data in their report will fall under false credit repair practices.

Therefore, credit repair service is legal. And if you don’t know how exactly you can fix your credit report then searching for a genuine credit repair company would be the only option you could be left with. But the only issue taking credit repairing services even the legit ones is such services come pricey. Even though one can make these corrections on their own, yet for selecting and performing one needs to put a lot of effort, time, and money into determining what they want to do.

What matters is not to put yourself into such a situation again and would not take a chance to knowingly dispute the right credit with the wrong one. Only focusing on making smart decisions can help you to rebuild your better credit report.

Does Credit Repair work?

If you are choosing a credit repair company and thinking does credit repair work? Then we suggest you choose them mindfully and not in hurry. There is no such data that proves taking credit repair services can boost people’s credit scores. Yet, such services help people in understanding what they can do to overcome credit issues and what they really can’t do.

We understand how time-consuming and tedious credit repair is. So, if you are new to credit issues and running out of time or in need of expert guidance then you can think of credit repair as an option.

Remember, it might take research and your time but doing things vigilantly is a smart move than being fooled by trusting scammers. You know how securing and affecting a better credit score is to acquire multiple things like loans, credit, mortgages, etc.

Therefore, as time goes by the impact of your previous mistakes will be diminished over time (of 7 years) if you start fulfilling every requirement on time.

Smart tips to find Credit Repair scams

There are plenty of organizations out there that can assure you to remove the unforeseen items from your report ethically and with legitimacy. But the question is, do your chosen companies legit? Or it is pretending to be.

To find its solution here is a list of smart tips (as per the Federal Tade Commission) you can consider to find out the guilty scammer-

-

Guarantee Boost in your Credit Score

Guaranteeing is the most common trick scammer companies use. It is every person’s dream to achieve a better credit score. Such weakness can easily be targeted by scam companies. Therefore, with smart research and mindful selection, you can choose the right expert who guides you about what you can do to fix your credit, not how frequently they can boost your credit score.

-

Demand Advance Payment

As per CORA’s norm, no company is entitled to sign their clients for making advance payments. If they make such requests without commencement of service, then their actions will be counted as unethical practice.

-

They told you, you cannot do it on your own

Is this the thing your preferred expert told you? If Yes, then consider it a red flag. A legit credit repairer will never hide anything from their clients. Since the option of a free credit report by Federal Law is there for general people. It is the information that every credit repair service provider should inform their client on prime.

Any service provider that does not inform their client in written format regarding such service titled “Consumer Credit File Rights Under State and Federal Law” will be tagged as a credit repair scam.

-

Inadequate knowledge and Ignorance

Did you ask any questions to your hired expert lately? Did they reply to all your queries frequently, or do they ignore reverting to you? Such actions are a clear indication of the company not being legit.

A company that is in constant practice in treating credits took their clients’ concerns on prime and respond as quickly as they can. Constant ignorance and not having adequate knowledge of their niche is a clear indication that they play around you.

-

Fake Representation

Is your hired company offered you a new credit identity recently? According to Federal Trade Commission (FTC), sharing social security numbers is a serious crime. Supporting such unethical practices would not only put such service providers behind bars but also their clients too.

-

No Written Contract

As per standard norms, credit repair companies should follow written contracts. That means they must intimate their clients considering their service norms, customer rights, terms and conditions, working conditions, and so on. If an organization denies you to provide a contract either in a written or soft format, then such organizations will directly be counted under unfair practices.

Bonus- How To Get Cleaned Credit For Free?

Use These Tips To Remove Negative Items For Free

So from above, it must be clear what credit repair is and how it is performed. Now, as a bonus here, we are telling you some easy-to-follow tips that you can follow to fix your credit on your own without spending dollars.

- Ask for a copy of your credit report

- Carefully analyze your credit report to find out if any inadequate information is there

- Jot down and make a clear list of things affecting your report and send it to Credit Beauros for investigation

- Make payments if you find any debts as soon as you find out any due.

Get your Credit Repaired Today!

Even though such credit can be treated independently, multiple people in the US prefer to repair their credit via credit repair services. The reasons could be anything from not having adequate time to not having specified knowledge. You can prefer to do it on your own however if you find yourself stuck at some point or need some expert helping hand. The Global Connect Pro is here to help you at every credit repairing step.

Write a reply or comment

You must be logged in to post a comment.