Merchant Cash Advance, How To Get Your Business Approved If You Have Been Denied Once?

On the off chance that your business wasn’t affirmed for a trader/business loan, don’t stress; you are not the only person who has come across this business fund freezing moment. Numerous business loan funding agents/institutions investigate applications intently.

They regularly consider your Mastercard deals and credit card sales, generally speaking, month-to-month deals sum, and other monetary variables. On the off chance that you don’t meet their necessities, you will not be affirmed for a vendor loan or as you understand it better the Merchant Cash Advance.

And most important of all, in any case, don’t allow a mere letter of disapproval of MCA to get your confidence or spirits down! Nobody likes getting dismissed. Notwithstanding, there are steps you can take to build your risks of getting endorsed for a future loan.

In this post, we’ll clarify how you can improve the probability of getting your next vendor loan application endorsed.

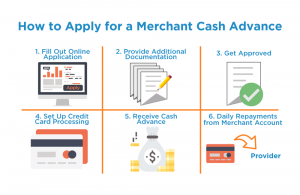

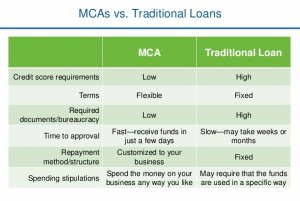

A Merchant Cash Advance. (MCA) isn’t an advance or specifically classified as a loan, yet rather a loan depending on the credit card deals stored in a business merchant account. An entrepreneur can apply for an MCA and have reserves stored into a business financial records lightning fast, in some cases as fast as 24 hours after endorsement or even less.

MCA providers assess the individual hazard, financial risk, and weight credit measures uniquely in contrast to a private financier or banker. These finance providers go through your everyday and monthly transactions very carefully to check and confirm if the borrower can repay the blended money (loan) in a fixed decided timeline that is fixed and can attract punitive measures if not paid on time.

The Visa and credit receipts are evaluated in detail to decide whether a business, its owner, and the security provider can take care of the development in a convenient way. Accordingly, rates on an MCA can be a lot higher than other financing alternatives so it’s basic you comprehend the terms you’re being offered so you can settle on an educated choice about whether an MCA bodes well to address your issues and requirements.

Inside the setting of an MCA, the expression “holdback” is likely the most unnatural. The holdback sum is the level of day-by-day Mastercard deals applied to your development. The holdback rate (somewhere close to 10 percent and 20 percent is ordinary) is generally fixed until the development is reimbursed.

Since reimbursement depends on a level of the day-by-day balance in the dealer account, the more charge card exchanges a business does, the quicker they’re ready to reimburse the development. Also, should exchanges be lower on some random day than anticipated, the draw from the vendor record will be less. All in all, the restitution is normally comparative with the approaching Visa receipts and credit details.

There’s a contrast between the loan fee an entrepreneur is charged for the development and the holdback sum. Most MCA suppliers charge what’s known as a “factor rate”. Dissimilar to a customary term credit, the rate isn’t amortized throughout the development. A run-of-the-mill factor rate for an MCA could go among twofold and triple digits relying on the supplier.

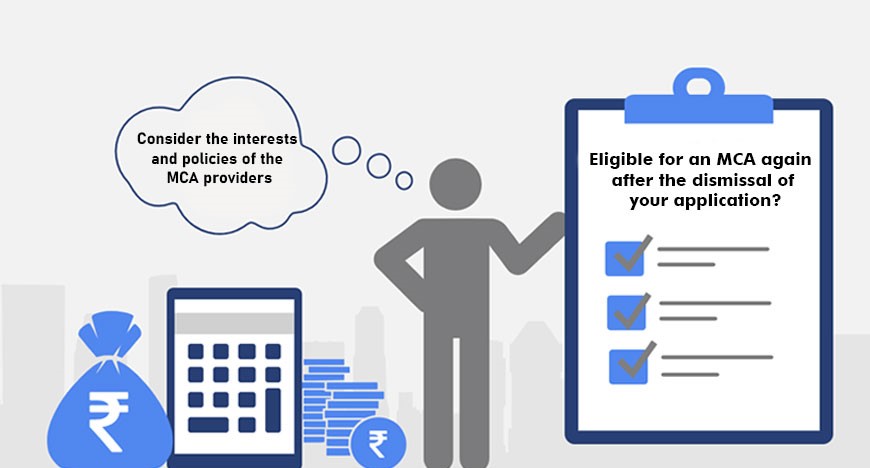

How to become eligible for an MCA again after the dismissal of your application?

Speedy Tips to read:

- Be respectful, proficient, and do not think about dismissal Personally.

- Request particulars, including how you could deal with getting your application cleared later on.

- Consider the interests and policies of the MCA providers, because after all, they are the sole pretext who will fund your small business and make a move, regardless of whether you plan on applying to an alternate funder.

- On the off chance that the sales and deals on your credit card are low for time being it probably is not a good idea to apply immediately but to have some patience and apply when your credit scores are back on the track.

- Apply to an alternate funder. They may have more indulgent capabilities, making it simpler for you to get your application affirmed with all the green signals.

- Gain from an earlier time. What made your application beforehand be dismissed? How might you address it with the goal that you can get endorsed sometime later?

1. First things first, ask the Funder “why your application was Rejected?

Is it accurate to say that you are uncertain of why your application was dismissed? It is not bad but a good idea to directly go to the source i.e. your loan supplier/approver that you applied through.

In the market, there are numerous dealers and loan organizations that will reveal to you why your application was dismissed. When you understand what their interests were, you might have the option to address them while applying later on.

While reaching the trader loan supplier or your funding approver, keep patience and be transparent. It might be consuming and affect your psyche if you continue to think about your application dismissal. Be that as it may, loan suppliers should run monetarily capable tasks, and there are sure dangers they attempt to stay away from, which of course is an important part of their job, to keep the fraudulent loan seekers away, that is why you should be as transparent and truthful.

When you comprehend their perspective, you might have the option to reapply. In any event, you can remember their interests while applying with different suppliers.

2. Be smart and check your application twice before making a reapplication

We comprehend that as an entrepreneur, you’re generally in a hurry and like to get your things fixed and get done ASAP. Because of this, you may be bound to simplify blotches on your application, basically because you’re shuffling such countless undertakings without a moment’s delay.

In any case, it’s imperative to focus on subtleties while finishing your application. Neglecting to incorporate data or giving off base figures could make you get precluded.

Sometimes, your funding official may circle back to you to fix the specific issues he has found out in your previous as well as the newly applied re-application. Many fund suppliers in the market will utilize this as motivation to dismiss your application but then again, you got to clear things out on your end by keeping the transparency as much as possible in disclosing your details and come out as a legit fund seeker, you see it’s your business and you treat your business as your blood child.

You take an extra mile to provide the best to your child, don’t you? Before presenting your application, require a couple of moments to carefully audit it, and have either your accomplice or a representative who has and keep your trust and present your interest as his interest. By re-perusing and remedying your answers, you could save your business from another dismissal.

3. Apply to Another Merchant Cash Advance Funder

Smart business owners like yourself must understand that one rejection is not the end of the business. That being said, take your rejection as a learning experience and come out as a more solid applicant by keeping all the pointers in mind which were the pretext of your application dismissal.

Make good use of your rejected application by getting it fully analyzed by a champion auditor in the market and once you find the issues you can further ask the auditor to fix the issues in your application, that’s how you roll and make sure that your new application doesn’t get rejected again but deliver the result that you were expecting, i.e. getting the approval of the funds for your business. Dismissal isn’t the apocalypse.

Truth be told, you could see it as a positive learning experience. By realizing why you were dismissed and how you can improve your application, you’ll increment your odds of future achievement. On the off chance that you’ve been dismissed by one funder, that doesn’t imply that you should call it quits.

All things being equal, apply to an alternate loan supplier. As you gain from your errors and more about the endorsement interaction, you’ll have the option to improve your application. This will build your odds of accomplishment.

4. Check out for more available option for your new application

A loan can be an incredible method to rapidly get the money infusion your business needs. Notwithstanding, in case you’re experiencing difficulty getting endorsed for a loan, think about elective types of financing.

Private company advances, charge cards, credit extensions, and different sorts of monetary subsidizing are accessible. It’s pivotal that you research these financing items preceding applying.

At times, these different types of financing will be more qualified for your organization. For instance, suppose your clients don’t utilize Mastercards oftentimes out of the blue. In any case, your business receipts show solid execution.

For this situation, an independent company credit might be more proper. Or on the other hand, you may like having a business Mastercard available for buys that you can rapidly pay off inside the month. In any case, it’s critical to decide the financing choice that will best suit your business requirements.

Keep all these pointers in mind before applying for the new MCA fund-seeking application and you won’t see the rejection but the approval coming your way.

Write a reply or comment