ERC Qualification Requirements: Not Just On The Basis Of Revenue

ERC (Employee Retention Credit) is a tax credit that was introduced by the U.S. government as a measure to help businesses retain their employees during the COVID-19 pandemic. The credit is designed to help businesses keep employees on their payroll, even if their operations have been disrupted due to the pandemic. The credit has been amended several times since its initial enactment as part of the CARES Act in March 2020.

One of the most significant changes to the ERC has been the expansion of the eligibility criteria beyond just revenue decline. The ERC can provide a significant financial benefit to businesses that qualify, but many business owners are unsure if they meet the eligibility requirements.

Keeping this in concern – In this blog, we’ll take a closer look at the ERC qualification requirements beyond revenue decline and understand why revenue is not the only factor that matters.

The Basics of ERC Qualification Requirements

To qualify for the ERC, businesses must meet certain eligibility requirements, which can be divided into two categories:

Eligibility requirements for 2020: For 2020, businesses must have experienced either a full or partial suspension of operations due to government orders related to COVID-19, or a significant decline in gross receipts.

Eligibility requirements for 2021: For 2021, businesses must have experienced either a full or partial suspension of operations due to government orders related to COVID-19, or a decline in gross receipts of 20% or more compared to the same quarter in 2019.

DID YOU KNOW?

While the decline in gross revenue is an important factor in determining eligibility for the ERC, it is not the only factor. Businesses that do not meet the gross receipts threshold may still be eligible if they meet other requirements.

Employers who have experienced a government-mandated shutdown, supply chain disruptions, or a lack of available employees may still be eligible for the credit, even if they have not experienced a significant decline in gross receipts.

Non-profits are also eligible for the credit, and there are some exceptions to the employee threshold. Employers must meet all the eligibility criteria and provide documentation to support their claim for the ERC.

For example– Businesses that were not in operation in 2019 can compare their 2021 gross receipts to the average quarterly gross receipts in 2020. Additionally, businesses that experienced a full or partial suspension of operations due to COVID-19 can qualify for the ERC regardless of their gross receipts.

How The Decline In Gross Receipts Is Calculated And What Qualifies As A Significant Decline

It is important to note that the ERC is available to eligible employers who have experienced either a full or partial suspension of operations due to COVID-19 or a significant decline in gross receipts during 2020 or the first three quarters of 2021.

The calculation of credit is performed on the basis of qualified wages offered to employees during the qualified period, i.e. $10,000 per employee.

The employer who qualifies for the ERC has been credited with a maximum of 50% of the first $10,000 in qualified wages, which is up to $5,000 per employee.

However, what many employers may not realize is that they may still be eligible for the ERC even if they have not experienced a significant decline in gross receipts. This is because the eligibility criteria have been expanded to include other factors that may have impacted the business due to COVID-19.

For example – If an employer has experienced a government-mandated shutdown or has been unable to operate due to supply chain disruptions or a lack of available employees, they may still be eligible for the ERC.

Employers Who are Eligible For The ERC

It is worth noting that the ERC is not only limited to for-profit businesses only. Some other Non-Profit Organizations (NPO) such as religious organizations, and churches are also eligible for the ERTC benefits.

The eligibility criteria for non-profits are slightly different, but they still include factors beyond revenue decline. Non-profits can qualify for the ERC if they have experienced either a full or partial suspension of operations due to COVID-19 or a significant decline in gross receipts during 2020 or the first three quarters of 2021.

The calculation of credit has been done on the basis of qualified wages paid to the employees during the eligible period, which is up to $10,000 per employee.

For the non-profit employer, the maximum credit calculation is 50% of the first 10,000 in qualified wages, which is up to $5000 per employee.

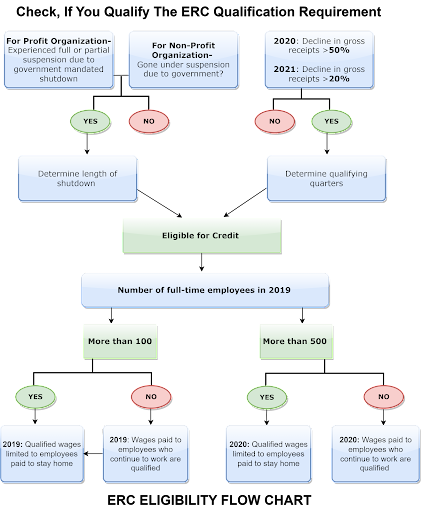

Let’s understand the above via ERC Eligibility Flow Chart –

Looking Beyond Revenue: Other Qualification Requirements For ERC

Another important factor to consider is the size of the business and the number of employees the business have. In 2020, businesses with 100 or fewer employees could claim the ERC for all employees, regardless of whether they were working or not. For 2021, the threshold was increased to 500 or fewer employees.

Employers with 500 or fewer employees are generally eligible for the credit, but there are some exceptions. For example, if an employer has more than 500 employees but has experienced a government-mandated shutdown, they may still be eligible for the ERC.

It’s also worth noting that businesses cannot claim both the ERC and the PPP (Paycheck Protection Program) for the same wages. If a business received a PPP loan in 2020, it cannot claim the ERC for the same wages paid with PPP funds.

However, businesses that received a PPP loan in 2021 can still claim the ERC for eligible wages. For this, it is compulsory that employers should also aid legit documentation to support their claim for the ERC.

As Has Been Demonstrated

While the decline in gross receipts is an important factor in determining eligibility for the ERC, it is not the only factor. Businesses that experienced a full or partial suspension of operations due to COVID-19 can qualify for the ERC regardless of their gross receipts. Additionally, businesses cannot claim both the ERC and the PPP for the same wages. To qualify for the ERC, businesses must also maintain documentation to support their eligibility.

The ERC can provide a significant financial benefit to businesses that qualify, but navigating the eligibility requirements can be complex. Business owners should work with their tax advisors to determine whether they meet the qualification requirements and to ensure that they are properly documenting their eligibility for the ERC.

If you believe your business may be eligible for the ERC, it is important to consult with a professional company like Gconnectpro.com to ensure you meet all the requirements and maximize your credit. By taking advantage of this tax credit, businesses can help to mitigate the financial impact of the COVID-19 pandemic and retain their valuable employees.

Write a reply or comment